All Categories

Featured

Table of Contents

When life stops, the dispossessed have no selection yet to maintain relocating. Almost promptly, families need to take care of the challenging logistics of fatality following the loss of a liked one. This can consist of paying expenses, separating possessions, and managing the funeral or cremation. But while death, like tax obligations, is inescapable, it does not need to concern those left behind.

In enhancement, a complete fatality advantage is frequently provided for accidental fatality. A modified death benefit returns premium typically at 10% interest if death takes place in the first 2 years and includes the most kicked back underwriting.

To finance this service, business count on individual health meetings or third-party information such as prescription backgrounds, fraud checks, or automobile documents. Underwriting tele-interviews and prescription histories can usually be utilized to assist the agent complete the application procedure. Historically business rely upon telephone meetings to confirm or validate disclosure, but more recently to improve customer experience, companies are depending on the third-party data suggested above and giving immediate choices at the point of sale without the interview.

Funeral Home Burial Insurance

What is final expenditure insurance coverage, and is it constantly the finest path ahead? Listed below, we take an appearance at how last expenditure insurance works and elements to think about before you acquire it.

However while it is explained as a policy to cover final expenses, recipients who obtain the survivor benefit are not called for to utilize it to pay for last expenditures they can use it for any kind of function they such as. That's because final expenditure insurance policy really falls under the group of changed whole life insurance policy or simplified issue life insurance policy, which are typically whole life plans with smaller sized death benefits, usually in between $2,000 and $20,000.

Our viewpoints are our very own. Interment insurance policy is a life insurance plan that covers end-of-life expenses.

Funeral Services Insurance

Burial insurance requires no medical examination, making it obtainable to those with medical problems. The loss of a liked one is emotional and terrible. Making funeral prep work and locating a way to spend for them while regreting adds another layer of anxiety. This is where having funeral insurance, also known as last expense insurance, comes in useful.

Streamlined problem life insurance coverage calls for a health evaluation. If your wellness condition invalidates you from standard life insurance, funeral insurance might be an alternative.

, burial insurance coverage comes in several types. This plan is best for those with moderate to moderate wellness problems, like high blood pressure, diabetic issues, or bronchial asthma. If you do not want a clinical test however can certify for a simplified problem plan, it is normally a better bargain than an assured issue plan due to the fact that you can obtain even more insurance coverage for a less costly premium.

Pre-need insurance policy is risky since the recipient is the funeral chapel and insurance coverage is specific to the picked funeral home. Should the funeral home fail or you vacate state, you may not have protection, and that beats the function of pre-planning. Furthermore, according to the AARP, the Funeral Service Consumers Alliance (FCA) discourages acquiring pre-need.

Those are essentially funeral insurance policy plans. For guaranteed life insurance coverage, premium calculations depend on your age, sex, where you live, and insurance coverage quantity.

Funeral insurance policy offers a streamlined application for end-of-life protection. Many insurance coverage business need you to speak to an insurance policy agent to use for a plan and obtain a quote.

The goal of living insurance is to relieve the concern on your loved ones after your loss. If you have a supplementary funeral service plan, your loved ones can utilize the funeral plan to manage last expenses and get an immediate dispensation from your life insurance to take care of the home loan and education prices.

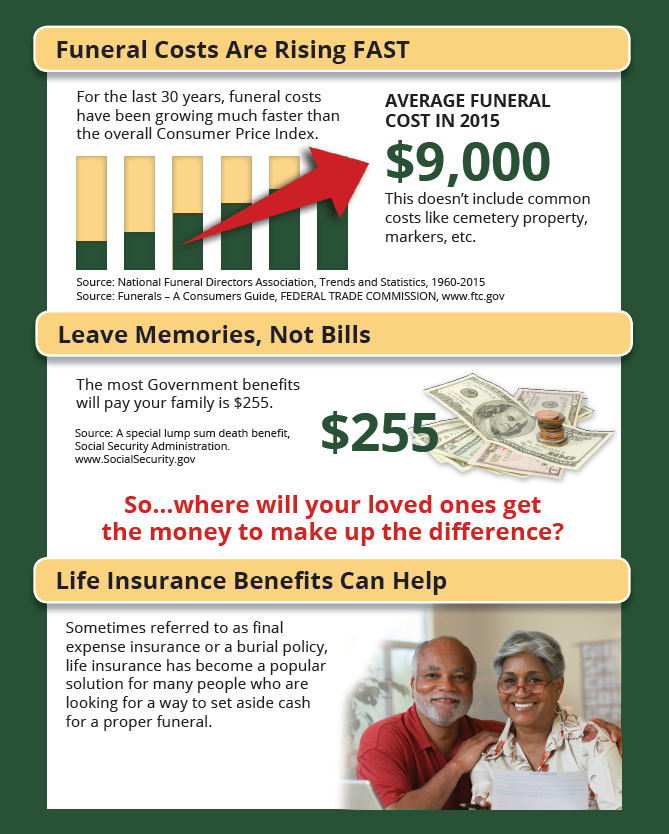

Individuals who are middle-aged or older with clinical problems may consider burial insurance policy, as they may not receive standard policies with more stringent approval criteria. In addition, interment insurance policy can be handy to those without considerable savings or standard life insurance policy protection. Funeral insurance policy varies from various other sorts of insurance coverage because it offers a reduced survivor benefit, typically only sufficient to cover expenses for a funeral and other linked expenses.

Seniors Funeral Plan

News & Globe Record. ExperienceAlani has examined life insurance coverage and pet dog insurance business and has written countless explainers on travel insurance policy, credit scores, financial debt, and home insurance policy. She is enthusiastic regarding debunking the complexities of insurance policy and various other personal money subjects so that visitors have the details they require to make the most effective cash decisions.

The more insurance coverage you get, the greater your costs will be. Final expense life insurance policy has a number of benefits. Namely, everyone who applies can get authorized, which is not the case with various other kinds of life insurance policy. Last expenditure insurance is frequently recommended for seniors that may not get standard life insurance coverage because of their age.

In addition, last cost insurance policy is valuable for people who intend to spend for their very own funeral service. Funeral and cremation services can be expensive, so last expenditure insurance offers comfort knowing that your enjoyed ones will not need to utilize their financial savings to pay for your end-of-life plans. Nevertheless, final cost insurance coverage is not the most effective item for every person.

Sell Final Expense Insurance From Home

Obtaining entire life insurance through Values is fast and very easy. Protection is offered for seniors between the ages of 66-85, and there's no clinical exam needed.

Based upon your actions, you'll see your estimated rate and the quantity of coverage you get (in between $1,000-$30,000). You can acquire a policy online, and your coverage begins quickly after paying the first costs. Your price never ever changes, and you are covered for your entire lifetime, if you proceed making the month-to-month repayments.

When you offer final cost insurance coverage, you can supply your customers with the peace of mind that comes with understanding they and their households are prepared for the future. Ready to find out everything you need to recognize to begin marketing last expenditure insurance coverage effectively?

Furthermore, clients for this sort of plan could have serious legal or criminal backgrounds. It is necessary to keep in mind that different providers offer a series of issue ages on their assured issue plans as low as age 40 or as high as age 80. Some will certainly additionally offer greater stated value, up to $40,000, and others will certainly allow for better death advantage conditions by improving the rate of interest with the return of premium or minimizing the number of years up until a complete survivor benefit is offered.

Latest Posts

Blended Term Life Insurance

Types Of Burial Insurance

Funeral Coverage Insurance